The 2018 year-end is approaching very quickly, and the first item of

compliance in January will be the Forms 1099. Kelly CPA wants to

help you understand the filing requirements and detail our service

offering to assist you with the 2018 filings.

As the IRS continues to enforce 1099 compliance by small businesses,

the risk of not filling out those forms correctly is too great to

not do it right. In fact, the IRS now requires you to answer these

questions on all Federal income tax returns:

*Did your business make any payments that would require it to file

Forms 1099?

*If “yes,” did the corporation file the required Forms 1099?

By responding to these questions, you are indicating (under penalty

of perjury) that your tax return is accurate and complete – including

1099 filing. By answering “no” to the second question, you are opening

your business to significant penalties and possibly audit.

Here are the basics you should know:

Who are you required to send a Form 1099?

Your business is required to send Form 1099 to vendors or sub-contractors who, during the normal course of business, you paid more than $600 for services, and that includes any individual, partnership, Limited Liability Company (LLC), Limited Partnership (LP) or estate. There are exceptions for entities that are taxed as a S or C Corporation. There are no exceptions for attorneys – if you used an attorney, you must send them a 1099. Your business also needs to issue a Form 1099 to a landlord you are paying rent.

What are the penalties?

Not providing a correct statement (intentional disregard) carries a penalty of $250 per 1099, with no maximum for the year. Late filing of Forms 1099 could lead to penalties ranging from $30 to $100 per 1099, with a maximum of $500,000 a year for your small business.

What are the deadlines?

Deadline to Payees: You are required to issue and mail out all Forms 1099 by January 31st. Deadline to IRS: You are required submit the Forms 1099 to the IRS with Form 1096 by January 31st. You may also have to file the Forms 1099 with various states.

Don’t worry about credit card payments and PayPal.

The IRS allows you to exclude from Forms 1099 any payments you made by credit card, debit card, gift card or third-party payment network such as PayPal. (These payments are being reported by the card issuers and third-party payment networks on Form 1099-K.)

How do I get this information? The Form W-9.

You get the information you need to issue the 1099 by requesting a W-9 from any vendor you expect to pay more than $600 before you pay them. Using this as a normal business practice will give you the vendor’s mailing information, Tax ID number and require them to indicate if they are a corporation or not.

Isn’t it easy to just click a button in QuickBooks Online to file these forms?

There is no easy button to filing your required Form 1099 in QuickBooks Online or Office Depot software. Be careful trusting these products just to save a few dollars. It can cost you significant penalties if you miss a vendor or report the incorrect amounts.

All this sound like fun? Wishing you would have kept better records when paying folks during the year? Kelly CPA can help.

Our 2018 Form 1099 service includes:

Review of vendor activities to determine which vendors should receive Form 1099

Assist with the collection of missing or incomplete W-9 from vendors

Preparation of Form 1099

Email and paper mailing of Form 1099 to vendors

Electronic filing of Forms 1099 and Form 1096 to IRS

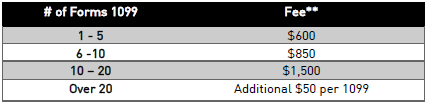

Our fee schedule for these services:

**If Kelly CPA prepared 1099s for your business in 2017, we will discount the fee 25%. This fee

includes all e-filing or process fees.

To meet the IRS deadlines, we would like to start as soon as possible. Please contact Kyle McKay at

[email protected] to get started as soon as possible.